Special economic zones (SEZs) in Egypt

Special Economic Zone (SEZ) is an area in which the business and trade laws are different from the rest of the country. SEZs are located within a country’s national borders, and their aims include increased investment, job creation, employment, and effective administration.

To encourage businesses to set up in the zone, financial policies are introduced. These policies typically encompass investing, taxation, trading, quotas, customs and labor regulations.

The term special economic zone can include:

- Free-trade zones (FTZ),

- Export processing zones (EPZ),

- Free economic zones (FEZ),

- Industrial parks/ industrial estates (IE),

- Freeports,

- Bonded logistics parks (BLP), and

- Urban enterprise zones.

In Egypt, up to now, only two special economic zones have been established under The Special Economic Zones Law No. 83 of 2002 “The SEZ Law”. The first is The Suez Canal Economic Zone (SCZone), the second is The Golden Triangle Special Economic Zone (GTZone)

The SCZone is a main service and trade center offering investment opportunities in various economic sectors including logistics, industry, Information & communication technology (ICT), renewable energy, business parks, and real estate developments as well as infrastructure services and transport links developments.

The target industries in the SCZone include; automotive assembly and components, chemicals and petrochemicals, construction and building materials, textile and readymade garments, agribusiness and food processing.

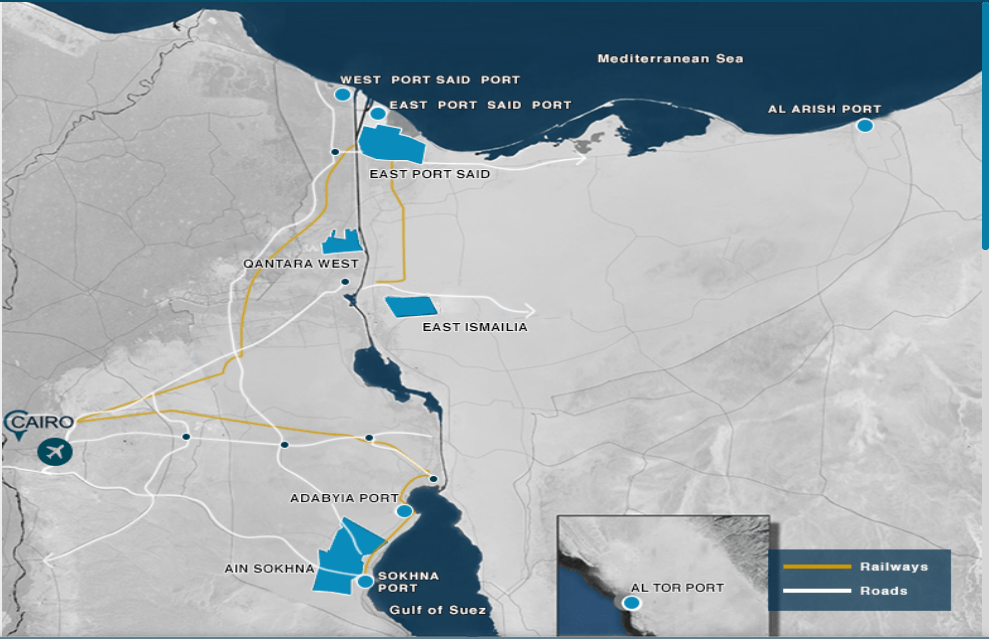

The SCZone Crossing 461 km2, and it consists of two integrated areas, two development areas, and six ports.

The two integrated areas are: Ain Sokhna, set aside for heavy industry and renewable energy manufacturing, and East Port Said, allocated to light industry and logistics

The two development areas are: Qantara West, a coastal area reserved for logistics, and East Ismailia (Technology Valley), targeted at agri-business, textiles and ICT industries

The six ports are East Port Said Port, West Port Said Port, El-Ein- ElSokhna Port, Adabiya Port, Al Tor Port, and Al Arish Port.

The SCZone is regulated by the Egyptian Law for Economic Zones of a Special Nature: Law No. 83 for 2002 and its amendment of 2015.

SEZ Law arranges several incentives and guarantees to encourage investments. It provides investors with certain tax and customs benefits, besides there are further non-tax incentives for labor-intensive projects and investments in certain sectors such as energy, agriculture, logistics, and transportation.

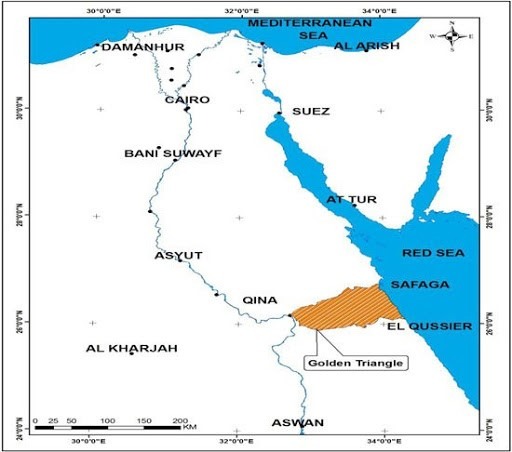

The Golden Triangle is an economic zone located between Qena, Safaga, and Al Qusair. It’s considered one of the richest areas in mining sources considering 75% of Egypt’s mining minerals. It’s a 9,200 square kilometer plot with recognized mineral reserves.

It already has basic infrastructure including railroads between Qina and Safaga; three ports, at Qusayr, Safaga, and Al Hamrawen; three airports, Luxor, Hurghada, and Marsa Alam; and numerous main roads including Safaga-Qina, Qusayr-Koft, Marsa Alam-Edfo, and the Red Sea Road.

This mining wealth will allow the region to set up new factories that produce cement, glass, silicon, chemicals, and computer chips.

The project aims to establish a new industrial capital by building an industrial, commercial, mineral, and touristic zone to serve, not only Egypt but the African continent.

Other projects will utilize raw materials to manufacture cement from clay and limestone and produce gasoline from oil-based clay.

The region is also rich with tourist attractions that set the foundation for many tourism projects.

The GTZone also is regulated by the Egyptian Law for Economic Zones of a Special Nature: Law No. 83 for 2002 and its amendment of 2015.

There is no project, whatever its legal form, shall be established in the economic zone of special nature, except after obtaining the approval of the Board of Directors of the Authority – The Authority in charge of setting up and developing the SEZ-.

The Application of such approval shall include the following data:

- Founders & their nationalities.

- The Purpose

- The investment costs

- The legal form

- The Capital

- The sources of financing

- The requirement from inside the country or overseas

- The areas required

- The number, Type, and nationalities of the Labor

- The environmental effects

- Other data that shall be required by Board of directors

The projects that will be established in SEZs shall have one of the following legal forms, Unless The Egyptian Laws require a specific legal forms:

- Sole proprietorship

- Branches of foreign companies

- A Limited Partnership

- A general Partnership

- A Joint-stock Company

- A Limited Liability Company

- A partnership limited by shares

Egypt’s recently ratified Investment Law (No.72 of 2017) which guarantees fair treatment to local and foreign investors alike.

Investment projects established after the implementation of this law, under the investment map, are granted special incentives through deductions from their net profit before tax.

Two sectors (“A” and “B”) have been determined for the application of and eligibility to special incentives under Article (11) of the Investment Law and are defined as follows:

Sector A projects enjoy a rebate of 50%of the investment cost in the form of tax deductions over some time. These projects are located within geographical areas that are underdeveloped, as per the investment map and the data and statistics issued from the Central Agency for Public Mobilization and Statistics. Additionally, investments in the SCZone and the GTZone are also classified as Sector A projects.

Type B projects enjoy a rebate of 30%of their investment costs in the form of tax deductions over some time.

These projects are located across the country and are classified as:

- Labor-intensive projects

- Small and Medium Enterprises (SMEs).

- Projects that depend on or produce new and/or renewable energy.

- Projects in the field of production and/or distribution of electricity.

- National and strategic projects to be listed under a resolution of the SCI.

- Tourism projects to be listed under a resolution of the SCI.

- Wood, furniture, printing, packaging and chemical industries.

- Industries associated with information and communication technology.

- Projects that are export-driven.

- Automotive manufacturers or producers within the automotive feeding industries.

- Pharmaceutical projects producing antibiotics, oncology drugs and cosmetics.

- Food and beverage projects, crop producers and recyclers of agricultural wastes.

- Engineering, metal, leather and textile-related projects.