Investment opportunities in Tanzania

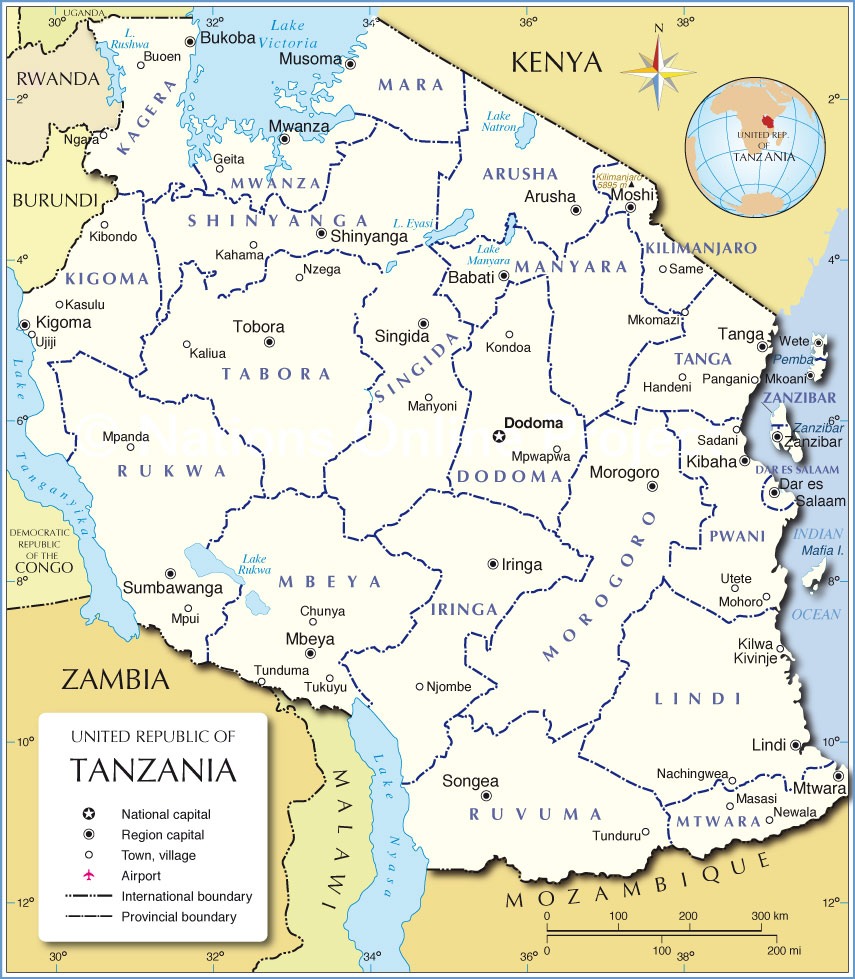

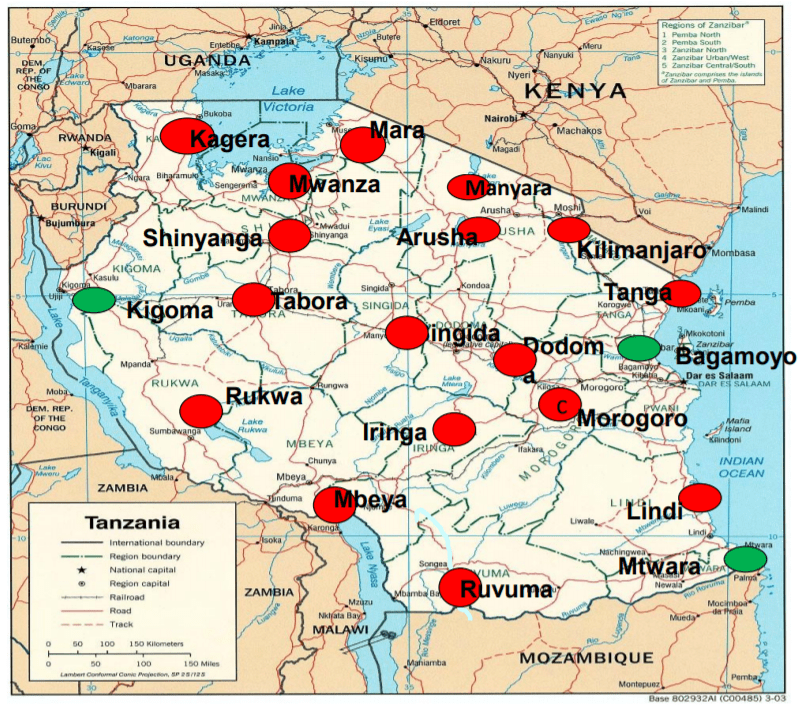

Tanzania is a country in East Africa, it’s officially known as the United Republic of Tanzania.

Tanzania’s economy is largely dependent on agriculture, which accounts for slightly less than one-quarter of GDP.

In Tanzania there are three avenues to invest through:

Export Processing Zones Authority (EPZA) is the principal Government agency for promoting investments in the Special Economic Zones in Tanzania.

In Tanzania, there are two investment schemes: The Export Processing Zones (EPZs) and the Special Economic Zones (SEZs).

** For more information about the required documents needed by EPZA for new investment assessment procedures please Click here.

Export Processing Zones (EPZs)

The Export Processing Zones Act 2002, The Export Processing Zones (Amendments) Act, 2006 and The Economic Zones Laws (Miscellaneous Amendments) Act, 2011) introduced the export processing zones to Tanzania intending to create international competitiveness for export-led economic growth.

The program provides mainly supports investment in the manufacturing sector and the establishment of export-oriented investments within the designated zones.

Types of Licenses issued by EPZA:

Investors are required to obtain a license from the EPZA to establish or operate in an EPZ or SEZ. These licenses are synonymous with the business licenses issued by Local Government Authorities and other Regulatory Authorities. Once an investor obtains the SEZ/EPZ license he or she does not require any other license except for highly regulated industries like food and drugs.

There are The three categories of the license issued by the EPZA and they are:

- Developer’s License: This license is given to the investor who is investing in development industrial parks infrastructure (internal roads, security fence, landscape, warehouses and factories, provision of utilities like power, water, sewerage systems, and telecommunications). The license is also given to the investor who wants to build a factory inside the industrial park or as a standalone unit for only EPZ investors.

- Operator’s License: This license is given to investors who are undertaking manufacturing operations. These operations may include processing activities like the addition of value to the products to semi-final product or final product

- Service Provider’s License: This license is offered to EPZ and SEZ investors who provide services and utilities within the industrial parks including services like banking, insurance, electricity supply, IT and ICT.

Eligibility Criteria for export processing zones EPZ licensing:

- To be a new investment

- At least 80% of goods produced/processed should be exported

- Minimum annual export turnover of US$ 500,000 for foreign investors and US$ 100,000 for local investors

- Investment can be located inside the Special Economic Zones Industrial Parks or in Standalone.

Special economic zones (SEZs)

Special economic zones in Tanzania were established under the Special Economic Zones Act, 2006 and its amendments d by the Economic Zones Laws (Miscellaneous Amendments) Act, 2011) to promote multi-sectoral investment for both domestic and foreign markets.

The special economic zone (SEZ) program scope covers a wider range of allowable economic activities than the export processing zones (EPZ).

The special economic zone (SEZs) include Export Processing Zone, Free Ports, Free Trade Zones, Industrial Parks, Regional Headquarters, Science and Technology Parks, ICT Parks, Agricultural Free Zones, and Tourism Development Zones and Business Incubation

Eligibility Criteria for special economic zones (SEZs) licensing:

- To be a new investment

- Minimum capital of US$ 500,000 for foreign investors and US$ 100,000 for local investors

- Goods produced/processed can be sold to the local or foreign market with no restriction on percentage

- The investment must be located in Special Economic Zones industrial park

Designated export processing zones (EPZs) and special economic zones (SEZs) areas in Tanzania include:

- Mbegani – Coast Region

- Malula – Arusha

- KIA – Kilimanjaro

- Kiyegeya – Morogoro

- Bunda, Tairo – Mara

- Bandari ya Mtwara – Mtwara

- Ujiji – Kigoma

- Kitengule – Kagera

- Luwawasi Mkuzo – Ruvuma

- Neema – Tanga

- Usagara, Nyan’gomango – Mwanza

- Iwambi –Mbeya

- Manyoni – Singida

- Kahama – Shinyanga

- Kilolo, Viwengi – Iringa

- Mererani/Simanjiro _ Manyara

- Ngongo Area – Lindi

Key Benefits of investing in export processing zones (EPZs) and special economic zones (SEZs):

- Exemption from payment of VAT and customs duties for raw materials, machinery, equipment, heavy-duty vehicles, buildings, construction materials and any other goods of capital nature to be used for purposes of development of the EPZ and SEZ infrastructure.

- Exemption from withholding tax on rent, dividends, and interest for 10 years.

- Exemption from taxes and levies imposed by Local Government authorities on products produced in EPZs.

- Exemption from VAT on utility and wharfage charges.

- Exemption from pre-shipment inspection requirement.

- Exemption from payment of withholding tax on interest on the foreign-sourced loan.

- Exemption on VAT and customs duties on one administrative vehicle firefighting equipment, two staff buses, and ambulance

- Unconditional transferability of profits dividends, royalties

- Privileged procedure on the work permit and visa

For more information about the incentives of investing in the SEZs & EPZs please Click here

- Tanzania investment center (TIC) is a government agency that promotes investment environment in Tanzania and facilitates investments in different sectors and at different locations.

- The agency deals with all enterprises of minimum fixed investment cost at least US$ 100,000 for projects which are wholly owned by Tanzanian Citizen(s) and US$ 500,000 for projects which are wholly owned by foreign investors or if a joint venture.

- Tanzania investment center TIC does not deal with enterprises that are prospecting to venture into mining and petroleum.

- Unlike export processing authority EPZA that deals only with new investments, Tanzania investment center TIC is encouraged in both new businesses and the expansion of existing enterprises.

- TIC coordinates investment in its totality and facilitates investments in different sectors and at different locations; whereas, export processing authority EPZA registers investors who intend to invest in export processing zones EPZs & special economic zones SEZs.

Zanzibar is a semi-autonomous region of Tanzania. It has separate legislation that governs investment promotion.

Zanzibar Investment Promotion Agency ZIPA is responsible for attracting and facilitating investments in Zanzibar including Free Economic Zones to make Zanzibar an attractive and competitive investment destination, regionally and globally.

Free economic zones in Zanzibar:

- Free economic zones in Zanzibar have been established to attract FDI, specifically labor-intensive projects and to increase exports.

- Companies set their business in those designated areas to enjoy simplified customs and other administrative procedures.

- There are five free economic zones in Zanzibar:

- Amani Industrial Park

- Micheweni Zone

- Fumba Zone

- Maruhubi Zone

- AirPort Zone

Eligibility Criteria for establishing business activity within Zanzibar Free Economic Zones:

- Carry out industrial or export-oriented business activities

- Export not less than 80% of its products / Services.

Key benefits of investing in Zanzibar Free Economic Zones:

There are 3 Categories on incentives for investors in Zanzibar Free economic zones

- Incentives for Free economic zones developers (Development of infrastructure)

- Incentives for Free economic zones Operators (Approved investors for sale into the Customs Territory)

- Incentives for Free economic zones Operators (Approved investors producing for export markets)

Incentives for Free economic zones developers (Development of infrastructure):

- Exemption from payment of taxes and duties for machinery, equipment, heavy-duty vehicles, building and construction materials and any other goods of capital nature to be used for purposes of development of the Free Economic Zone infrastructure.

- Exemption from payment of corporate tax for an initial period of 10 years and thereafter a corporate tax, shall be charged at the rate specified in the Income Tax Act.

- Exemption from payment of withholding tax on rent, dividends ‘and interest for the first 10 years.

- Exemption from payment of property tax for the first 10 years

- Remission of customs duty, value-added tax and any other tax payable in respect of the importation of one administrative vehicle, ambulances, firefighting equipment, and fire fighting vehicles and up to two buses for employees’ transportation to and from the Free Economic Zone.

- Exemption from payment of stamp duty on any instrument executed in or outside the Free Economic Zone relating to transfer, lease or hypothecation of any movable or immovable property situated within the Free Economic Zone or any document, certificate, instrument, report or record relating to any activity, action, operation, project, undertaking or venture in the Free Economic Zone.

- Treatment of goods destined into Free Economic Zones as transit goods.

- On-site customs inspection of goods within Free Economic Zones.

Incentives for Free economic zones Operators (Approved investors for sale into the Customs Territory):

- Approved Investors whose primary markets are within the customs territory shall be entitled to the:

- Remission of customs duty, value-added tax and any other tax charged on raw materials and goods of capital nature related to the production in the Free Economic Zones.

- Exemption from payment of withholding tax on interest on the foreign-sourced loan.

- Remission of customs duty, value-added tax and any other tax payable in respect of the importation of one administrative vehicle, one ambulance, firefighting equipment, and fire fighting vehicles and up to two buses for employees’ transportation into and from the Free Economic Zones.

- Exemption from pre-shipment or destination inspection requirements.

- On-site customs inspection of goods within Free Economic Zones.

- Subject to compliance with applicable conditions and procedures for foreign exchange and payment of tax whenever appropriate, unconditional transfer through any authorized dealer bank in freely convertible currency of;

- Net profits or dividends attributable to the investment.

- Payments in respect of loan servicing where a foreign loan has been obtained.

- Royalties, fees, and charges in respect of any technology transfer agreement.

- The remittance of proceeds in the event of sale or liquidation of the licensed business or any interest attributable to the licensed business.

- Payments of emoluments and other benefits to foreign personnel employed in Tanzania in connection with the licensed business.

Incentives for Free economic zones Operators (Approved investors producing for export markets):

- Approved Investors who are producing for export markets in non-manufacturing or processing sectors shall be entitled to:

- Compliance with applicable conditions and procedures, accessing the export credit guarantee scheme.

- Remission of customs duty, value-added and any other tax charged on raw materials and goods of capital nature related to the production in the Free Economic Zones.

- Exemption from payment of corporate tax for an initial period of 10 years and thereafter, a corporate tax shall be charged at the rate specified in the Income Tax Act.

- Exemption from payment of withholding tax on rent, dividends, and interests for the first 10 years.

- Exemption from payment of all taxes and levies imposed by the Local Government Authorities for products produced in the Free Economic Zones for 10 years.

- Exemption from pre-shipment or destination inspection requirements.

- On-site customs inspection of goods in the Free Economic Zones.

- Remission of customs duty, value-added tax and any other tax payable in respect of the importation of one administrative vehicle, ambulances, firefighting equipment, and vehicles and up to two buses for employees’ transportation to and from the Free Economic Zones.

- Treatment of goods destined into Free Economic Zones as transit goods.

- Compliance with applicable conditions and procedures for foreign exchange and payment of tax whenever appropriate unconditional transfer through any authorized dealer bank in freely convertible currency of:

- Net profits or dividends attributable to the investment

- Payments in respect of loan servicing where a foreign loan has been obtained.

- Royalties, fees, and charges in respect of any technology transfer agreement.

- the remittance of proceeds in the event of sale or liquidation of the business enterprises or any interest attributable to the investment;

- payments of emoluments and other benefits to foreign personnel employed in Tanzania in connection with the business enterprise;

- 20% percent of total turnover is allowed to be sold to the local market and is subject to the payment of all taxes.

- 100% foreign ownership is allowed.

- NO limit to the duration that goods may be stored in the Freeport Zones.

Export Processing Zones (EPZs)

- The Export Processing Zones Act 2002

- Export Processing Zones (Amendments) Act, 2006

- Economic Zones Laws (Miscellaneous Amendments) Act, 2011)

- The Export Processing Zones Act – Revised edition of 2012

Special economic zones (SEZs)

Zanzibar Free Economic Zones