After the severe damage caused by the Coronavirus to the stock market and the economy, the virus struck the interest rates too.

Negative interest rates mean that investors will get back less money than they put into government securities instead of earning interest, and that cash deposited at a bank yields a storage charge, rather than the opportunity to earn interest income. They reverse normal lending costs. Commercial banks must pay to keep their money in central banks, rather than collecting interest on it.

That means they should have an incentive to lend their money at low cost to other banks, businesses, and consumers while charging some customers to deposit cash. In theory, that encourages people to borrow more, spend more and save less—stimulating the economy until negative rates aren’t needed.

Previously seen as a sort of theoretical thought experiment and a line that should never be crossed, the central bankers of some countries, notably slow-growing economies such as Japan and Switzerland, have experimented with setting negative interest rates.

Sweden’s central bank was the first to deploy them: In July 2009, the Riksbank cut its overnight deposit rate to -0.25%.

The European Central Bank (ECB) followed suit in June 2014 when it lowered its deposit rate to -0.1%.

However, places with negative rates such as Japan and Europe have had mixed results. Other European countries and Japan have since opted to offer negative interest rates, resulting in $9.5 trillion worth of government debt carrying negative yields in 2017.

Also, no major bank that introduced negative rates during Europe’s debt crisis has turned the main policy rates positive again, The Wall Street Journal reported.

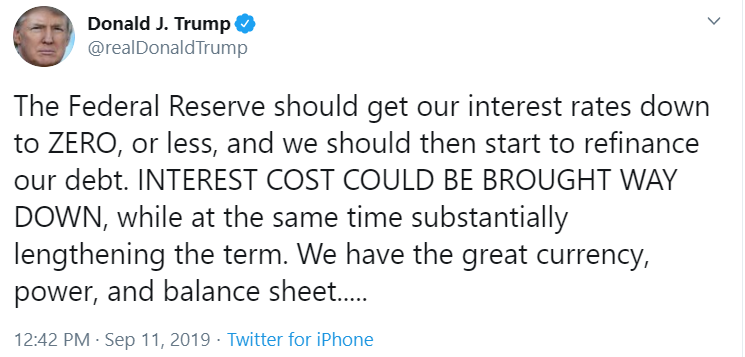

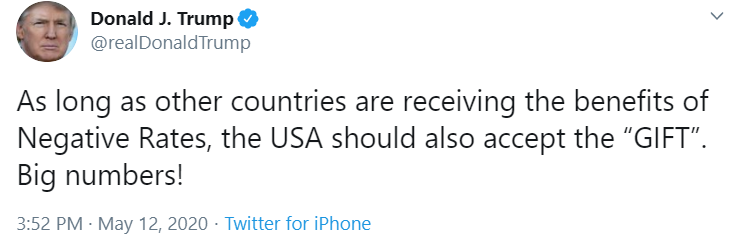

In the United States, although President Donald Trump has been pushing the Fed toward taking its interest rates to below zero since late last year and renews the call for negative interest rates, says other countries are already enjoying the ‘gift’, on the 13th of May, the Fed Chairman Jerome Powell declares that the central bank is not considering negative interest rates at this point, even as other central banks appeared to be opened to the idea — such as the Bank of England —.

Also, Jerome Powell said in a congressional testimony that “When you have negative rates, you wind up creating downward pressure on bank profitability, which limits credit expansion”

Social media has reacted to the prospect of ever-lower rates with jokes about “negative interest rate credit cards” that earn you money the more you shop.

“Negative interest rates are intended as a disincentive for people to hold cash instead of using money to purchase goods and spend money,” said William Isaac, a former Federal Deposit Insurance Corporation chairman, and co-chairman at the Isaac-Milstein Group.

“Negative interest rates are intended as a disincentive for people to hold cash instead of using money to purchase goods and spend money,” said William Isaac, a former Federal Deposit Insurance Corporation chairman.

According to a paper by the Committee on the Global Financial System, these tools were effective in avoiding deflation though they did squeeze bank profits.

But “there is little if any evidence that negative rates actually stimulate growth, inflation, or improve bank lending,” said David Lebovitz, a global market strategist at JPMorgan Asset Management.

The paper also warned that long-term effects of negative interest rates can’t be fully determined either.

Even if the rate is not negative, it does appear that a low-interest-rate environment is here to stay